1. INTEREST RATE DECISION

- The Federal Reserve held rates unchanged at 4.25-4.50% at its January meeting, on par with market expectations.

- Solid labor market performance and somewhat elevated inflation kept officials neutral as they continued to assess the impact of the three consecutive rate cuts made at the end of 2024.

- A slight adjustment in the Fed’s meeting statement this month deemphasized inflation’s “easing”, language that accompanied the December decision. Markets initially interpreted the Fed’s change in language as a hawkish signal, dampening equities and sending treasury yields higher. However, markets reverted following Chair Powell’s post-meeting briefing, in which he affirmed that the FOMC feels confident in the economy and its policy options’ flexibility.

- Powell confirmed that Fed researchers are keeping an eye on proposed changes to trade, immigration, and regulatory policy due to their potential impact on inflation and employment. However, when pressed about the anticipated effects of these changes, Powell stated that officials would withhold that assessment until specific changes become clearer.

2. TREASURY MARKETS

- The current yield on a 10-year US treasury bond is hovering near 5%. While rising long-term yields sometimes reflect an anticipation of higher growth and the higher rates needed to keep the economy from overheating, it may reflect concerns about America’s fiscal trajectory.

- Yields climbed in reaction to the FOMC’s January interest rate decision, where the committee held rates unchanged and referenced both confidence and uncertainty about economic developments.

- Recently, some fixed-income analysts have warned that rising bond yields signal a higher term premium demanded to fund US debt, reflecting concern about the inflation and fiscal risks from trade uncertainty.

- Analysts say bond markets could play out in several ways. On the one hand, a deregulatory push could boost economic potential and dampen the term premium. Meanwhile, a cascading trade dispute or a tax cut extension without significant spending cuts could renew upward pressure on yields.

3. THE AI RACE AND DATA CENTER DEMAND

- A shocking AI advancement by Chinese company DeepSeek upended the US tech market this week as investors reassess the dominance of US tech firms in the AI race. It also sparked debate about domestic data center demand.

- Data centers have garnered increased attention in recent years as the AI race takes off due to the nascent technology’s high electricity demand. According to the investment bank Jefferies, projected AI needs represent 75% of the overall US electricity demand through 2035 in most forecasts.

- However, DeepSeek raised the stakes for US AI firms after building a generative AI model with significantly less hardware and energy, challenging the energy-demand thesis driving data center development. US utility firms dependent on data center demand also saw their stock prices take a hit following the DeepSeek news.

- Nonetheless, a more competitive AI space would likely create down-the-road opportunities for data centers. As AI infrastructure becomes cheaper to build and AI applications become easier to produce, it could funnel new capital into startups and widen the customer base for data center providers.

4. BUSINESS UNCERTAINTY

- According to the Atlanta Federal Reserve’s January 2025 Survey of Business Uncertainty, sales revenue growth expectations have risen in recent months but remain more uncertain compared to pre-pandemic averages.

- The survey, which polls about 1500 senior managers at US firms monthly, shows that year-ahead sales growth expectations are the highest since the end of 2022. Additionally, expected employment growth has improved recently, while uncertainty surrounding employment growth has returned to pre-pandemic levels.

- Sales uncertainty has fallen but remains high by historical standards. As of January 2025, year-ahead sales growth uncertainty is at its lowest since 2020 but continues to hover close to around 4% compared to a pre-pandemic coalescing around 3%.

5. CONSUMER CONFIDENCE

- US consumer confidence fell at the start of the year, according to the latest reading from the Conference Board.

- While some deterioration was expected following a holiday season bump, the index, which measures American’s assessment of both current conditions and their six-month outlook, fell steeper than most economists expected.

- The current conditions index tumbled 9.7 points in January, while the more narrowly scoped labor market conditions index fell for the first time since September.

- American’s short-term expectations for income, business, and the job market also fell. However, anticipation of a recession over the next 12 months remained relatively low.

6. RETAIL SALES

- US retail sales were up 0.4% month-over-month in December, according to the latest data from the Census Bureau.

- The reading reflects some added momentum to consumer activity to close 2024 and prompted some economists to revise up their growth forecasts for 2025.

- While the holiday season contributed to the uptick, sales rose 4.2% from December 2023. According to the retail trade report, strong demand for motor vehicles and non-store retailers helped drive the increase, with sales up 8.4% year-over-year and 6.0% year-over-year, respectively.

- Strong retail data also likely contributes to the Fed’s caution around rate cuts as they monitor demand indicators to prevent an inflation resurgence.

7. LOGISTICS PROPERTY RENTS DROP

- According to new data from Prologis, rent growth for US logistics properties turned negative in 2024, the first drop in 15 years.

- Rents in the US and Canada fell by 7% on average, steeper than the 5% decline experienced globally. The decline was partly led by slower growth in markets with recently high competition rates, such as Phoenix.

- US logistics rents are still up 59% compared to 2019, leaving most inventors well positioned, while lower rents could entice new tenants looking to scoop up cheap space in the high-demand sector..

8. INDEPENDENT LANDLORD RENTAL PERFORMANCE

- According to the Chandan Economics-RentRedi Independent Landlord Rental Performance report, the on-time payment rate in independently operated rental units slipped by 70 basis points (bps) in January and is down 112 bps year-over-year, falling to 85.0%.

- On-time collections had stabilized for the latter half of 2024, holding between 85.4% and 85.8% from July through December. January’s estimate signals some deterioration in tenant payments—as it currently stands, this month’s on-time collection rate is the lowest on record since April 2021.

- Western states continue to hold the highest on-time payment rates in the country, led by Idaho, Utah, Nevada, North Dakota, and Colorado.

- Meanwhile, 2-4-family and single-family rental properties held the highest on-time payment rates in January, reaching 85.2%.

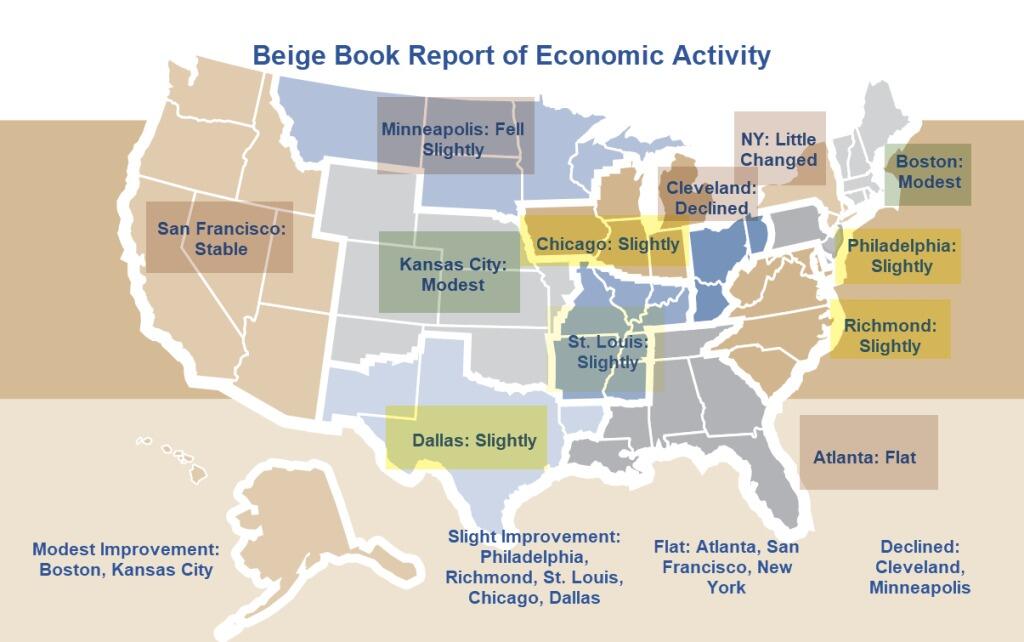

9. BEIGE BOOK

- According to the Federal Reserve’s latest Beige Book, economic activity increased “slightly” to “moderately” in most regions between late November and early December, driven by higher-than-expected consumer holiday spending.

- Construction activity generally declined as producers reported high materials and financing costs that dampened business expansion. Residential real estate activity was on balance unchanged as elevated mortgage rates kept demand at bay. Commercial real estate sales ticked up.

- Manufacturing declined slightly, with many manufacturers reportedly stockpiling inventories in anticipation of higher tariffs. Meanwhile, truck freight volumes fell.

10. NEW HOME SALES

- Sales of newly built single-family homes jumped by 3.6% in December to a seasonally adjusted annualized rate of 698k, the highest increase since September and well above market expectations.

- Sales growth was sustained despite a surge in mortgage rates during the month. The West region of the US led by volume, selling at an annualized rate of 154k units per year. The West was followed by the Northeast, with an annualized rate that would amount to a 41.7% increase. Sales rates in the South and Midwest fell.

- The median price of a newly built single-family home was $427k, up from $402k in December.

SUMMARY OF SOURCES

1. 2025 COMMERCIAL REAL ESTATE OUTLOOK

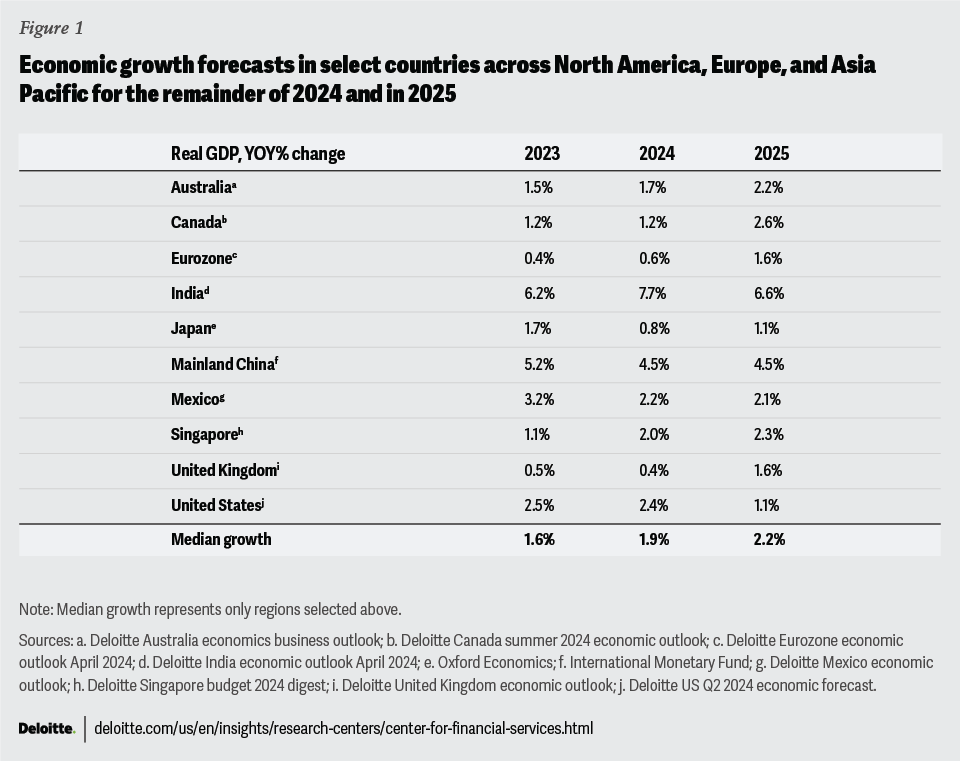

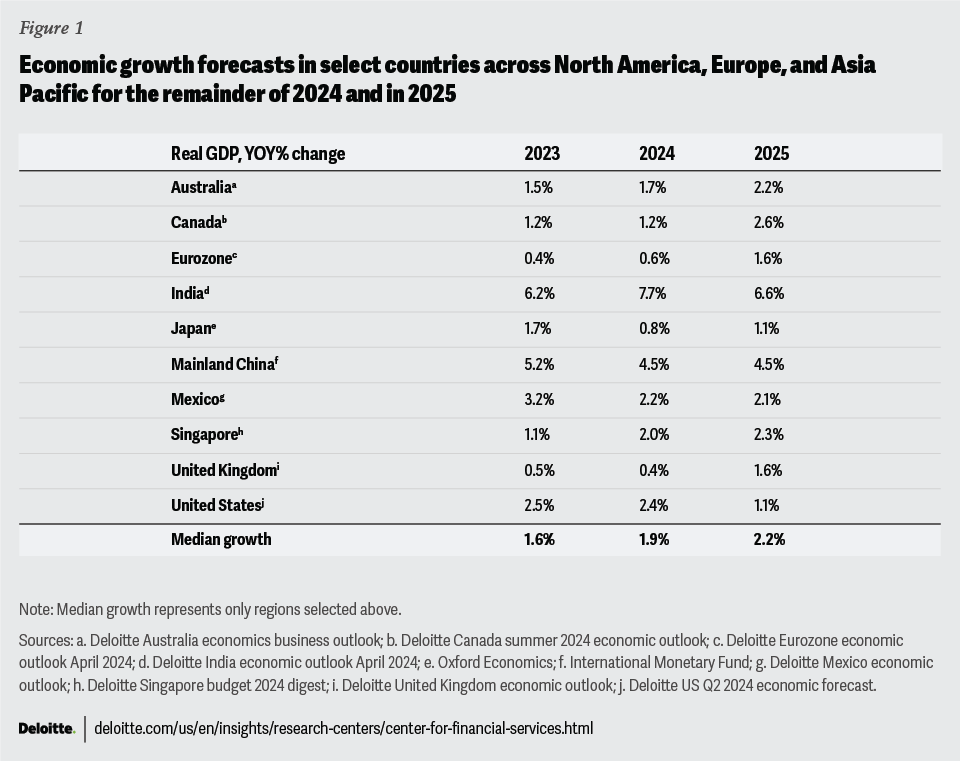

- According to Deloitte’s 2025 look-ahead, the current outlook for Commercial Real Estate is dominated by expectations surrounding global interest rates, renewed revenue sentiment, and the potential for industry-wide shifts in areas such as AI, climate resilience, and regulation.

- Rates are projected to fall across most major economies in 2025 — however, so is growth. Deloitte’s forecast projects that Real US GDP will fall from a projected 2.4% annual growth rate in 2024 to 1.1% in 2025. The Fed’s interest rate pivot has boosted CRE market sentiment. Still, uncertainty around the timing and volume of rate cuts will keep some capital deployment at bay until things become clearer.

- Revenue growth is expected to recover, with 88% of global executives surveyed by Deloitte anticipating higher revenue next year compared to 2024. For context, 60% of executives forecasted declines coming into 2024. In the year ahead, roughly two in three respondents expect revenue to increase by more than 5%.

- Data and technology, including AI development, are seen as key drivers of growth in the coming years. 81% of executives plan to increase their technology investments.

- Climate resilience also continues to be an increasing focus of CRE leaders. 76% of survey respondents plan to invest in significant energy retrofits over the next 12-18 months.

2. CPI INFLATION

- According to the Bureau of Labor Statistics, the Consumer Price Index (CPI) rose 0.2% month over month in October and 2.6% year-over-year, each roughly in line with expectations.

- Core-CPI, which removes the more volatile food and energy components, accelerated 0.3% month-over-month, boosted by shelter costs, which accounted for half of the gain in overall CPI. Meanwhile, the energy component held flat while the food index climbed by 0.2% in the month.

- Other notable increases included used vehicles, which rose 2.7% month-over-month, and airfares, which jumped 3.2% during the month.

- Inflation-adjusted wages increased modestly, rising 0.1% month-over-month and 1.4% from one year ago.

- With CPI arriving roughly in line with expectations, the reaction from the interest rate futures market was negligible. At their upcoming December policy meeting, the FOMC is projected to make one additional quarter-percentage-point cut before the end of the year.

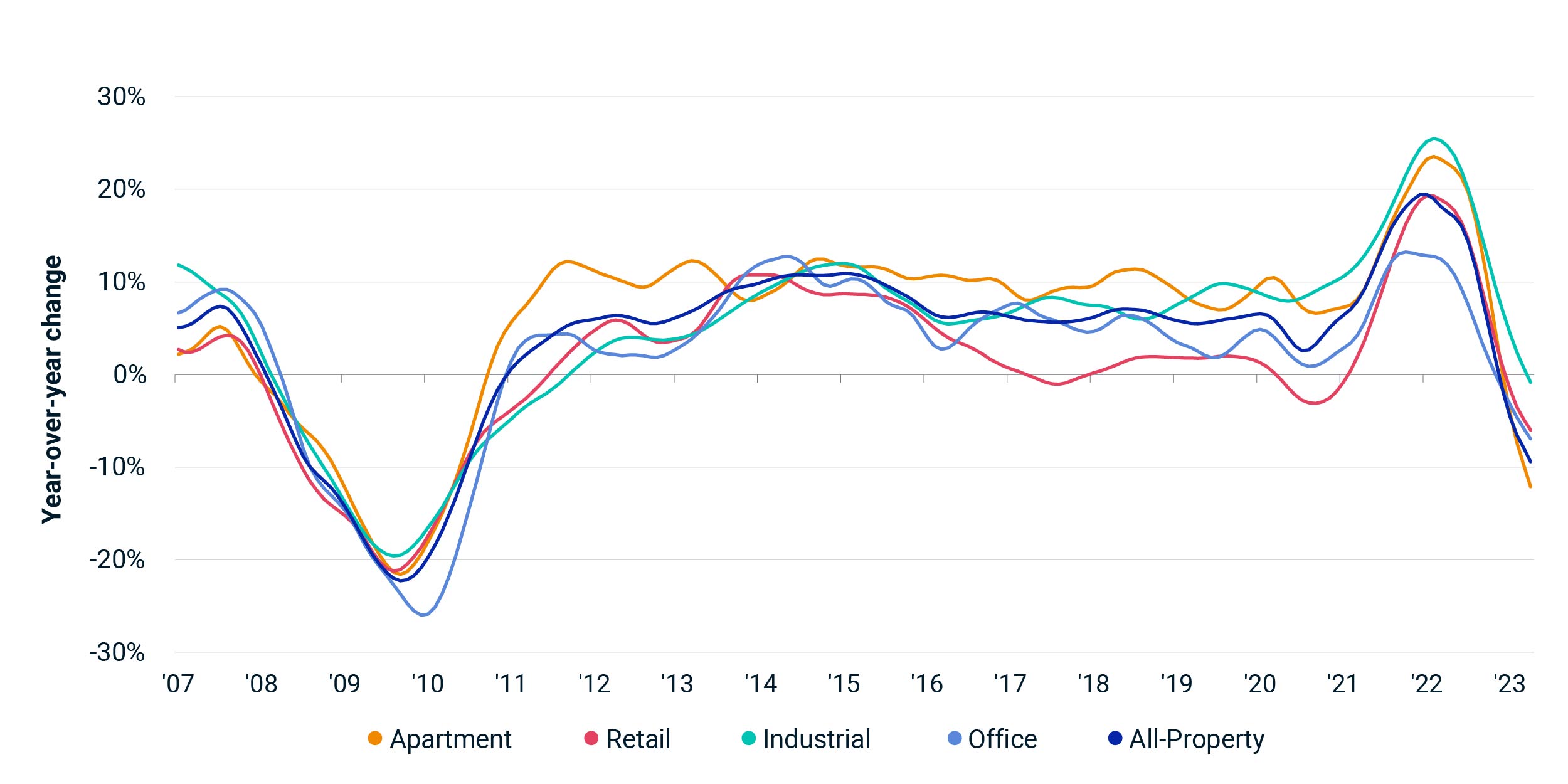

3. COMMERCIAL PROPERTY PRICES

- According to the MSCI-RCA Commercial Property Price Index, national commercial real estate prices fell just 0.1% month over month and -1.5% year-over-year through October. This performance represents a gradual recovery of commercial prices as the market reaches a cyclical inflection point.

- Apartment prices fell by 0.3% from September and 6.1% year-over-year through the end of October. Retail property prices fell 0.1% from September and 1.9% year-over-year.

- Industrial again emerged as the only major asset group to post a monthly or annual increase, rising 0.6% month-over-month and an impressive 7.6% over the past 12 months.

- The Office sector as a whole fell by 0.1% month-over-month, but suburban office prices climbed by 0.1%. All office segments continue to post year-over-year declines — but suburban office prices have gradually improved this year, resulting in a positive three-month moving average for the broader office sector.

4. INTEREST RATES

- According to the Chicago Mercantile Exchange’s Fed Watch Tool, there is a 55.5% chance that the FOMC will follow through with a 25-basis point cut at their December policy meeting, reflecting a relatively split futures market. The forecast has declined from just a week earlier when futures markets priced in an 82.5% probability of cut.

- The split sentiment reflects monetary doves who, on the one hand, reference a recent labor market slowdown and shift in the Fed’s dual mandate focus to predict further accommodation. On the other hand, monetary hawks note strong economic growth and Fed officials’ relative caution over cutting too fast as evidence that rates may remain where they are as we turn to the new year.

- At the FOMC’s November meeting, the committee voted to cut the Federal funds rate by 25 basis points, following up on their 50-basis point cut in September that began their pivot to accommodative monetary policy.

5. NON-BANK CRE BORROWING

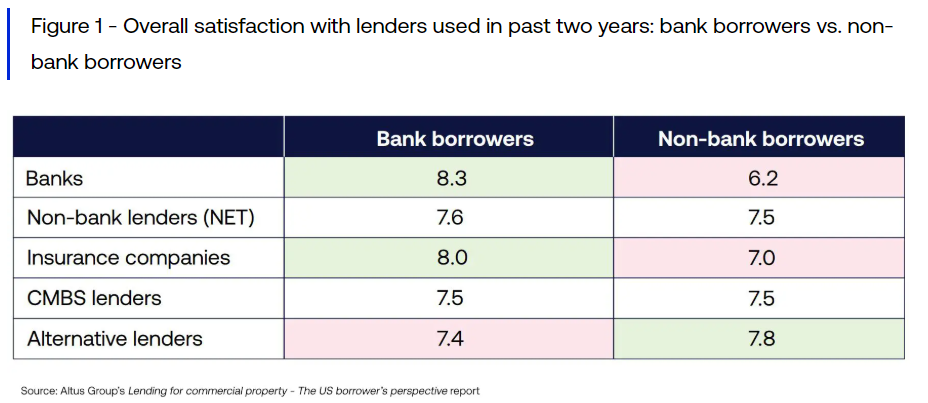

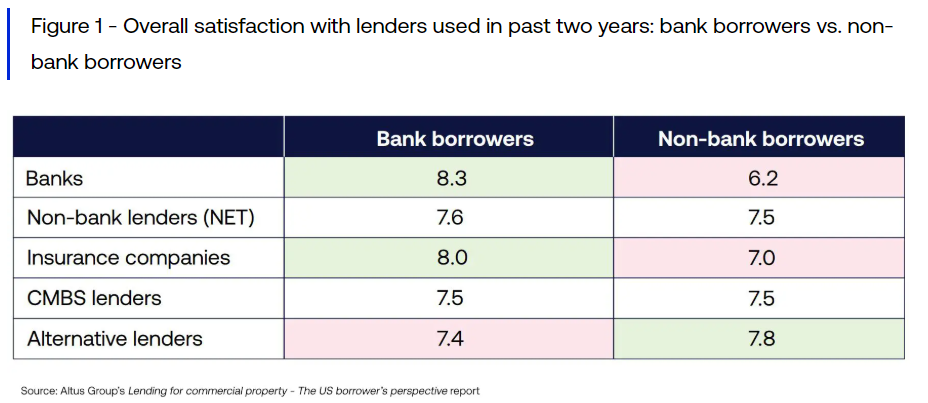

- A recent Altus group survey investigated the experiences that commercial real estate borrowers have had with non-bank lenders and polled their expectations, recommendations, and challenges.

- Borrowers polled expressed a desire for greater efficiency and consistency from their lenders. Bank borrowers expressed higher overall satisfaction with their CRE lenders, while non-bank borrowers referenced flexibility and service as the top factors for their choice.

- Non-bank borrowers reported fewer steps to secure financing than bank borrowers. However, their deals tended to move more slowly. Moreover, some expressed higher levels of concern about managing market risks and challenges they expect to face in the coming years.

6. NAHB HOUSING MARKET INDEX

- The latest data from the National Association of Home Builders’ Housing Market Index shows that it reached its highest level in seven months during November, exceeding expectations.

- The index received a post-election bump, as builders expressed confidence that the Republican sweep of Congress and the White House will increase the likelihood of significant regulatory relief and boost construction activity.

- The current sales conditions indicator rose on the month, as did the gauge that measures sales expectations for the next six months. Prospective buyer traffic also posted a modest gain from October.

- There was also a modest decline in the share of builders cutting prices and their amounts. 31% of homebuilders slashed prices in November, compared to 32% in October, while the average price reduction was 5%, slightly below the 6% rate posted in October.

7. INDEPENDENT LANDLORD RENTAL PERFORMANCE

- According to the latest report from Chandan Economics, the on-time payment rate in independently operated rental units remained flat at 85.5% in November compared to the previous month.

- On-time collections are down by 70 bps from a year earlier. Moreover, compared to the post-pandemic peak of 88.2% set in April 2023, on-time payments are down by 279 bps, reflecting some sustained performance deterioration.

- Still, there are signs that on-time collections are stabilizing. For the past five months of data, on-time payment rates have held between a low of 85.3% and a high of 85.7%.

- Trends within key rental subsectors reveal a slight performance gradient. Of the three tracked property sub-types, properties with 2-4 rental units and single-family rentals (SFR) led the way in November 2024, with the two subsectors holding an on-time payment rate of 85.7%, respectively. Multifamily properties sat slightly lower at 85.1%.

- Measured by State, western-located properties continue to outperform the rest of the country. In November 2024, on-time payment rates stood highest in Alaska (93.7%), followed by Nevada (91.9%), Utah (91.4%), Colorado (91.4%), and New Mexico (91.1%).

8. ENGINEERING & CONSTRUCTION INDUSTRY OUTLOOK

- According to Deloitte’s 2025 Engineering and Construction Industry Outlook, the improving interest rate outlook, technological integration, and navigating the policy landscape will guide the industry over the next year.

- Falling rates are expected to boost construction demand across various segments and create growth opportunities in 2025. However, labor market challenges persist. The engineering and construction sector faces a significant talent shortage, posting an average of 382k job openings between August 2023 and July 2024.

- Cost overruns from inflation and interest rates will incentivize firms to focus on value creation and sustaining growth through strategic divestitures and rebalancing capital allocation. Large construction firms may optimize portfolios by divesting noncore assets and doubling down on core investments.

- Like other sectors, adopting AI and other digital tools to enhance productivity and address labor gaps will be crucial to the engineering and construction field. Technologies such as digital twins, robotics, and generative AI will continue to transform operations in the industry.

- The policy outlook is also key. Recent federal investments through the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the CHIPS and Science Act will continue to trickle into markets in the coming year. The activity is expected to drive growth in the manufacturing and energy sectors and generate downstream demand for engineering and construction firms.

9. HOUSING INVENTORY REBOUND

- According to a recent analysis by ResiClub, 54 of the nation’s 200 largest housing markets have inventory levels above their pre-pandemic levels, a significant jump from just 17 at the end of 2023.

- From October 2019 to October 2021, the number of US actively listed homes fell from 1.2 million to just 566k, a 53% drop in just two years.

- However, inventory is gradually recovering, reaching 954k through October 2024, still a large but more modest 21% below the 2019 benchmark.

- Smaller markets have tended to be the ones to see the most recovery. Huntsville, AL, Killeen-Temple, TX, and Lubbock, TX, have experienced the strongest post-pandemic recoveries but rank 108, 119, and 162, respectively, in national metro size.

- The Bridgefield-Stamford-Norwalk, CT metro remains the furthest below pre-pandemic levels, followed by Connecticut’s largest metro area, Hartford-East Hartford-Middletown. Peoria, IL, ranks the third furthest below 2019 levels.

10. NMHC QUARTERLY SURVEY OF APARTMENT CONDITIONS

- According to the Q3 NMHC Survey of Apartment Conditions, Multifamily financing and sales volume reached their highest level since 2022 during the third quarter.

- 43% of respondents reported higher sales in Q3 2024 compared to 32% during the previous quarter. With the Fed’s first interest rate cut only coming in September, the early pace of thawing deal activity is an encouraging indicator for the sector.

- The equity financing gauge rose from an index level of 49 in the previous quarter to 67 in the Q3 reading. In October 2023, the reading stood at just 18.Optimism increased around debt financing, with 62% of respondents seeing now as a better time to take out a Multifamily mortgage, compared to just 37% who expressed this sentiment in Q2.

- Looking market to market, 38% of respondents listed “primary markets” like New York, San Francisco, Los Angeles, and Miami as benefiting from sales activity better than the secondary or tertiary markets that dominated initial post-pandemic activity. Still, roughly 45% saw no change.

SUMMARY OF SOURCES

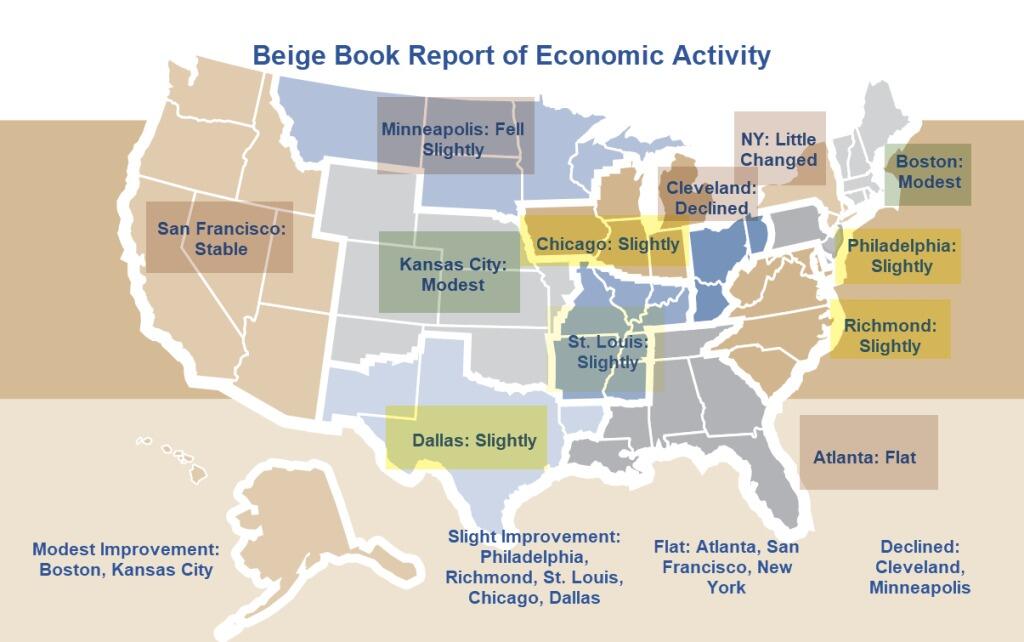

1. ECONOMIC ACTIVITY REMAINS STEADY

- According to the October 23rd release of the Federal Reserve’s Beige Book Summary of National Economic Activity, activity has changed little in nearly all districts since early September, though two districts have reported modest growth.

- The latest Beige Book provides an additional glimpse at how the US economy has performed in the weeks leading up to and following the Fed’s interest rate pivot.

- In early September, macroeconomic and labor data persuaded some observers, including many Fed officials, that it was time to move into a more accommodating stance with slowing inflation and economic activity.

- In the weeks following the cut, robust jobs data and a slight acceleration in consumer prices have dampened the worries surrounding growth and caused markets to rethink their interest rate projections. Treasury yields have grown, showing that markets expect a higher new normal for interest rates.

- Nonetheless, the relatively unchanged nature of economic activity, according to the anecdotal Beige Book, offers little clarity on the question. Economic sentiment was surveyed between August 27th and October 18th, with the interest rate cut coming in the middle of the survey period and unlikely to have significantly impacted week-to-week activity shifts.

2. MORTGAGE DEMAND & INTEREST RATES

- Mortgage applications fell by 6.7% during the week ending on October 18th, according to the latest data from the Mortgage Bankers Association. It was the fourth consecutive weekly decline.

- New mortgage applications fell roughly 5.0% during the week, while refinance applications fell 8.5% week-over-week.

- The latest data comes one week after a sharp 17% drop in overall mortgage activity and is in line with the increases in benchmark interest rates that have occurred since the start of October.

- The ongoing acceleration in benchmark rates is in reaction to strong recent solid economic data such as the September jobs report, and better-than-expected retail sales, and unemployment claims data, with Treasury markets reflecting doubt that the Fed will cut rates as quickly as markets were previously pricing in.

3. DEBT MARKET OPPORTUNITIES IN THE OFFICE MARKET

- Work-from-home headwinds and elevated interest rates have stifled the US Office sector — but a recent report by Hines delves into why an upcoming wave of loan maturities may create an opportunity for new funding mechanisms.

- The analysis discusses signs of higher-quality office assets performing well in the new work-from-home normal. Class A buildings represent roughly 27% of the US Office stock.

- With valuations down and the work-from-home shift largely priced in, the risk is falling for newly originated loans, and lower LTVs could mitigate the risk of any principal loss. Higher yields on debt may also provide further cushioning.

- As property owners look to fill the gap between equity and what is likely to be smaller senior mortgages, funding opportunities in the mezzanine are likely to multiply, the analysis finds.

4. RETAIL SALES

- Retail sales jumped by 0.4% between August and September, a significant increase above the 0.1% monthly rate recorded in August and beating consensus forecasts of a 0.3% rise.

- Misc. store retailers recorded the most significant jump in sales, rising by 4% during the month. Clothing sales were up 1.5%, health and personal care sales were up 1.1%, and food and beverage retailers saw a 1.0% increase.

- Other retail groups experiencing month-over-month increases in sales growth include food services and drinking places (+1.0%), general merchandise stores (+0.5%), non-store retailers (+0.5%), sporting goods, hobby, musical instrument, and bookstores (+0.3%), and building material and garden equipment supply dealers (+0.2%).

- Conversely, electronics and appliance store sales fell by 3.3% month-over-month, while gas stations and furniture stores experienced declines of 1.6% and 1.4%, respectively.

5. CMBS DELINQUENCIES JUMP

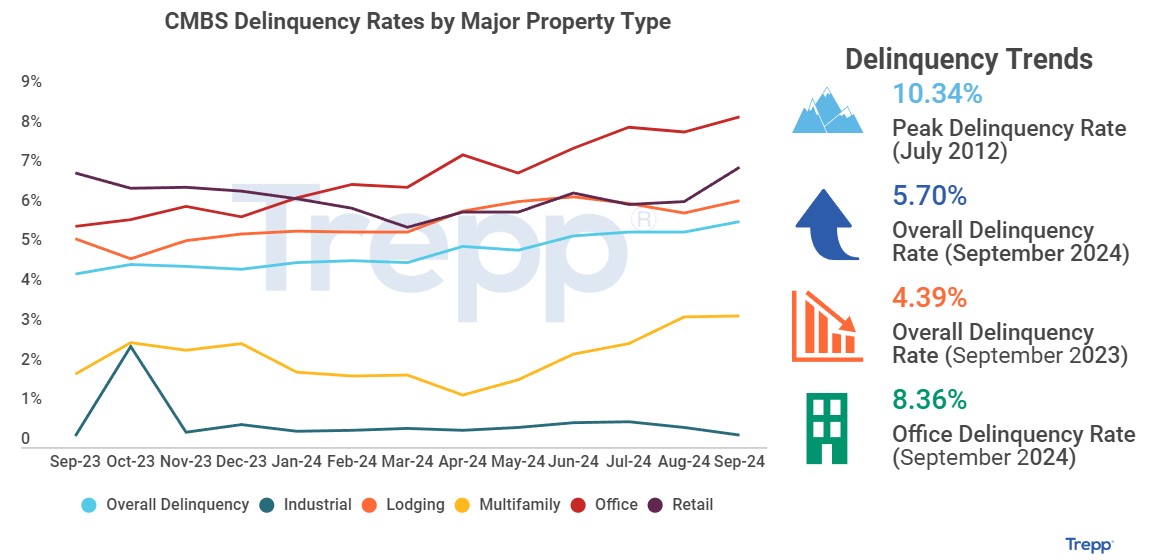

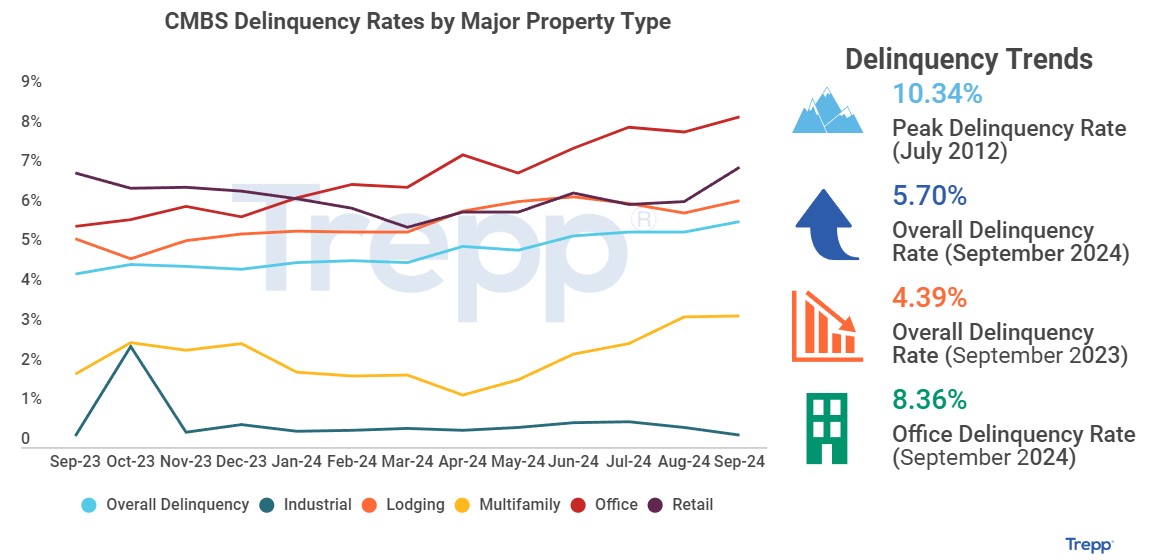

- CMBS Delinquencies continue to climb across all property types, with the indicator tracked by Trepp up 26 basis points to 5.70% in September. The delinquency rate is up 131 basis points over the past 12 months.

- The Retail sector was a key contributor to the increase, accounting for roughly 50% of the monthly rise in the headline rate. The Retail delinquency rate rose 86 basis points in September to 7.07%, its first time crossing the seven percent threshold since April 2022.

- Office accounted for 37% of the $2 billion increase in overall delinquent loans in the CMBS market, up 39 basis points to 8.36%.

- Lodging and Multifamily delinquencies also climbed, up 32 and 3 basis points respectively.

- Industrial was the sole sector to see a decline in delinquencies, falling eight (8) basis points to 0.32%.

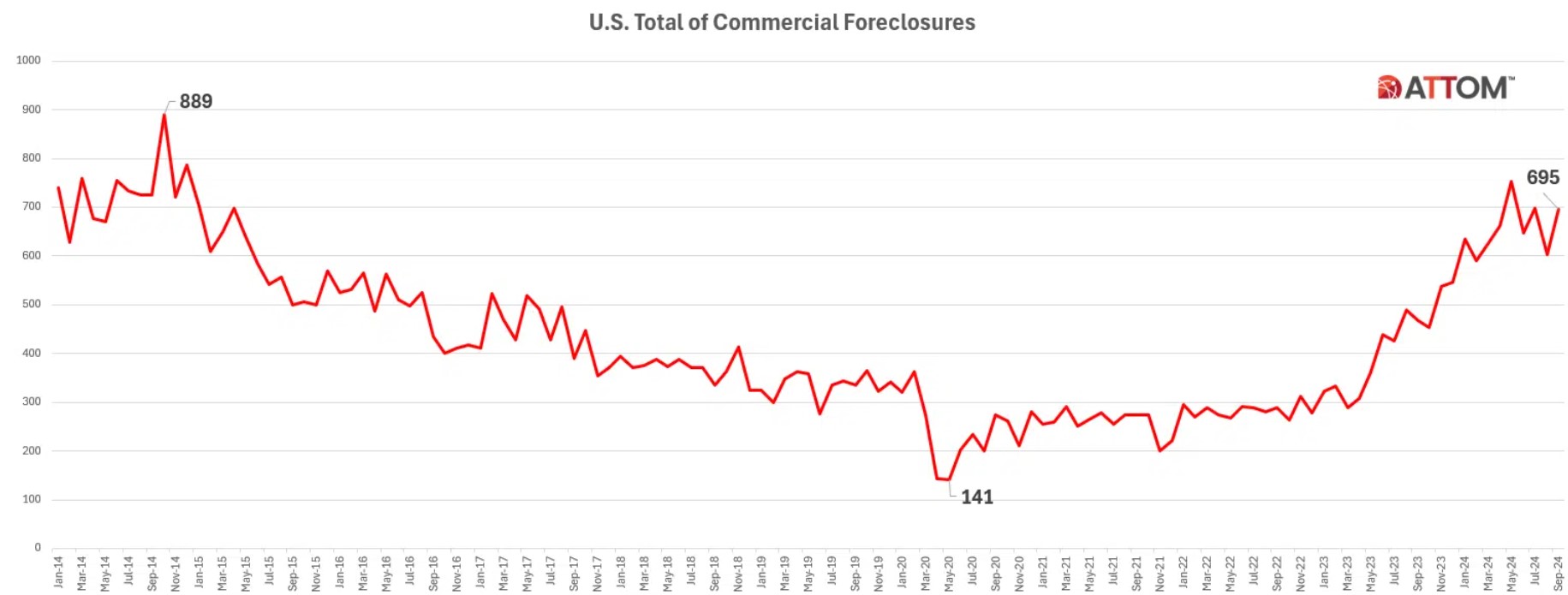

6. COMMERCIAL FORECLOSURES

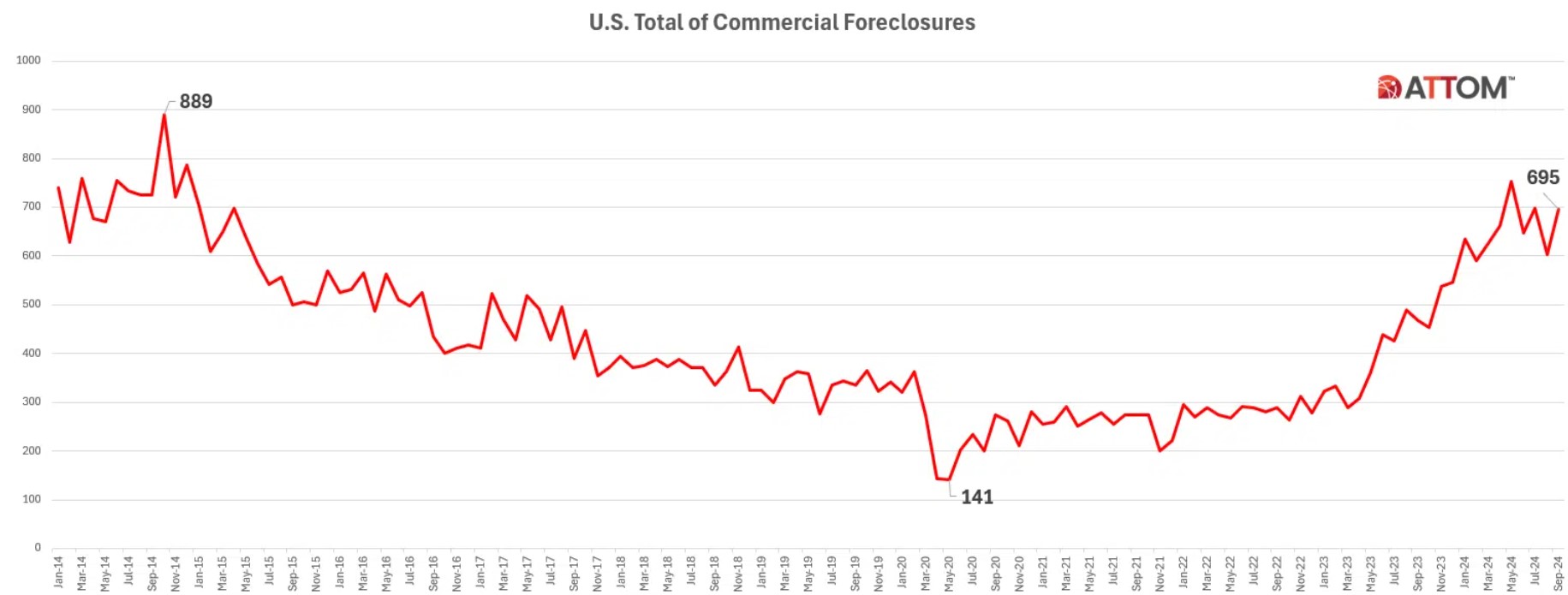

- According to the most recent monthly US Commercial Foreclosures report by ATTOM, while commercial foreclosures appeared to have peaked in May 2024, they remain elevated over pre-pandemic figures.

- Foreclosures began steeply rising in June of 2023 before peaking at 752 in May 2024. In September, ATTOM registered 695 commercial foreclosures, a modest rise from summer numbers, suggesting that foreclosures may settle into higher equilibrium while CRE dynamics continue to transition.

- According to historical data, foreclosure activity has seen large fluctuations over the past decade shaped by economic conditions and structural shifts, such as during the COVID-19 pandemic. The decade high remains an October 2014 total of 889 before foreclosures began to decline during the latter half of the 2010s.

7. CONSUMER SENTIMENT

- According to preliminary estimates, the University of Michigan Consumer sentiment index declined in October to 68.9 after reaching a five-month high of 70.1 in September and arrived slightly below a forecasted level of 70.8

- October ends consecutive monthly increases for the index, which experienced a relatively steady decline across the first six months of the year. The index started the year at 79 points in January and reached a year-to-date low of 66.4 in July.

- Both the current conditions and the expectations sub-indices weakened in October.

- Year-ahead inflation expectations rose slightly to 2.9% from 2.7% the month before, aligning with the slight uptick in price pressures experienced between September and October.

- The five-year-ahead outlook for inflation eased from 3.1% to 3.0%.

8. INDEPENDENT LANDLORD RENTAL PERFORMANCE

- On-time rental payments in units operated by independent landlords jumped higher in October 2024, reversing a trend of four consecutive declines.

- An estimated 85.5% of tenants in independently operating rental units completed their monthly payments on time. The on-time payment rate improved by 30 basis points (bps) from the prior month, though it remains down by 79 bps from the same time last year and 275 bps from the post-pandemic peak.

- Following exceptional apartment sector rent growth in 2021 and 2022, on-time payments began falling in the Spring of 2023 — from a high of 88.3% to a low of 85.2% in September 2024. However, while on-time collection performance has deteriorated in the past year, the October data offer a hopeful sign that the worst has passed.

- Of the three tracked property sub-types, properties with 2-4 rental units had the highest on-time payment rate in October 2024, coming in at 85.7%. Single-family rental (SFR) followed next with an on-time payment rate of 85.6%. Meanwhile, average on-time payment rates in multifamily properties sat slightly lower at 85.1%.

- Measured by State, western-located properties continue to outperform the rest of the country. On-time payment rates stand highest in October 2024 in Nevada (94.5%) — followed by Utah (94.1%), Idaho (92.5%), Colorado (92.2%) and California (91.7%).

9. FOREIGN-BORN HOUSEHOLDS MAKE UP ONE-FIFTH OF US RENTAL DEMAND

- According to a recent Chandan Economics analysis of Census Bureau data, out of the 36.3 million rental households in the US, 9.4 million have a head of household born outside the country — accounting for 21.0% of total rental demand.

- Foreign-born US households are roughly 30% more likely to be renters than their US-born neighbors. With US population growth projected to sink lower in the coming decades — due in part to a falling birth rate — the dependence on foreign-born rental demand could continue to accelerate in the years to come.

- Over the past two decades, the foreign-born share of US rentals has gradually grown, from 17.8% of rental households at the turn of the century to a peak of 21.1% in 2016. Between 2017 and 2020, the share declined to 20.0% before climbing again in 2021 and 2022, reaching its previous high.

- Between 2000 and 2022, the number of foreign-born rental households in the US has grown by 47.6% — more than double the growth for US-born rental households (+20.5%) over the same period.

10. HIGHER INFLATION FOR LOW-INCOME HOUSEHOLDS

- A recent analysis by the Federal Reserve of Minnesota dives into mounting research showing diverging inflation patterns for lower vs higher-income households experienced both before and after the pandemic.

- Their modeling finds that since 2005, prices have risen 64% on average, for the lowest-income households, while the highest-income households have seen prices in their basket increase 57%.

- Zeroing in on the post-pandemic inflationary period, the poorest households have seen prices rise about two percentage points more than the richest ones—or about 8.3% faster than the average consumer price index (CPI) over this period.

- While these margins appear small in absolute terms, the differences are amplified when considering several underlying factors that affect poorer households, including the varying ability of households to substitute their purchases and how modest changes in purchasing power compound changes in income over time.

SUMMARY OF SOURCES

SHAREABLE FLIPBOOK DOWNLOADABLE PDF

After finishing my professional hockey career, I transitioned into commercial real estate, managing a portfolio of 20 properties across the U.S. I’m now a licensed advisor with SVN Vanguard in Irvine, specializing in retail strip center sales and landlord/buyer representation. Real estate runs in my family—my father led Center Business Management in Los Angeles, and my grandfather co-founded La Mancha Development, building thousands of mini-malls throughout Southern California. My goal is to carry that legacy forward with a strategic, client-focused approach that delivers long-term value.

Specialties

Landlord Rep, Tenant Rep

Sale Specialties

Retail

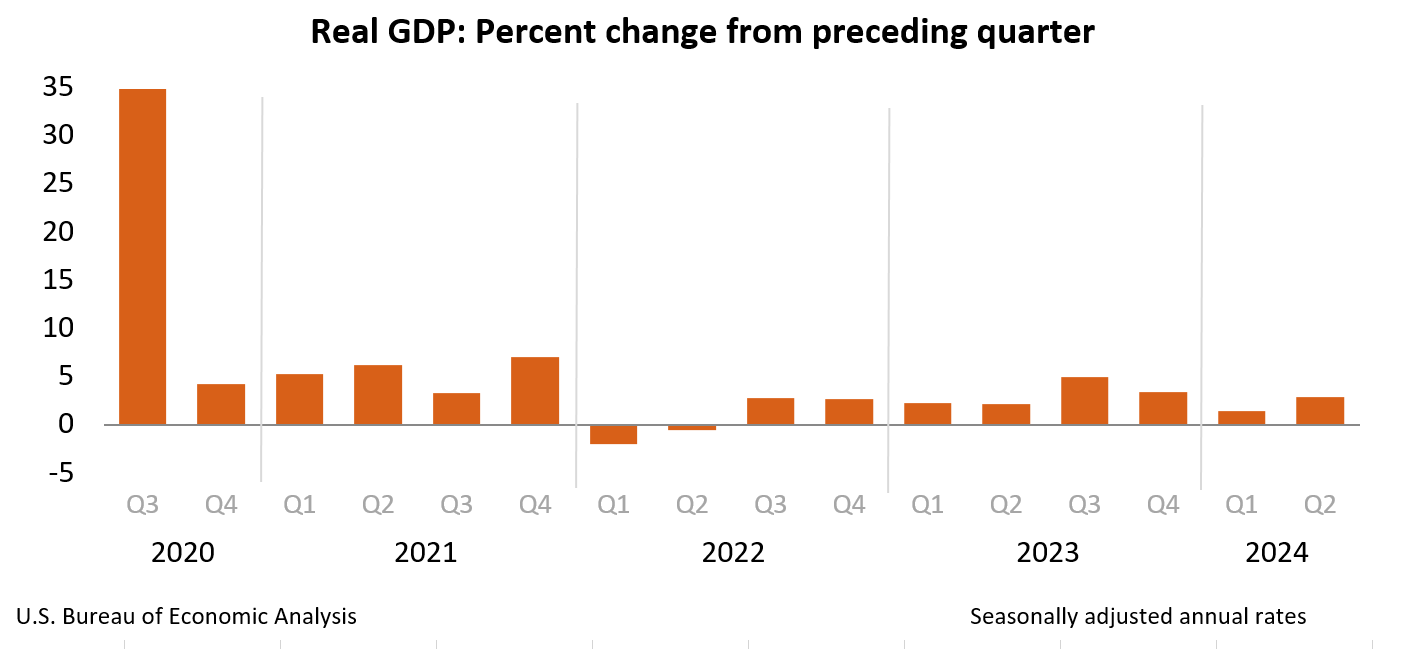

1. GDP

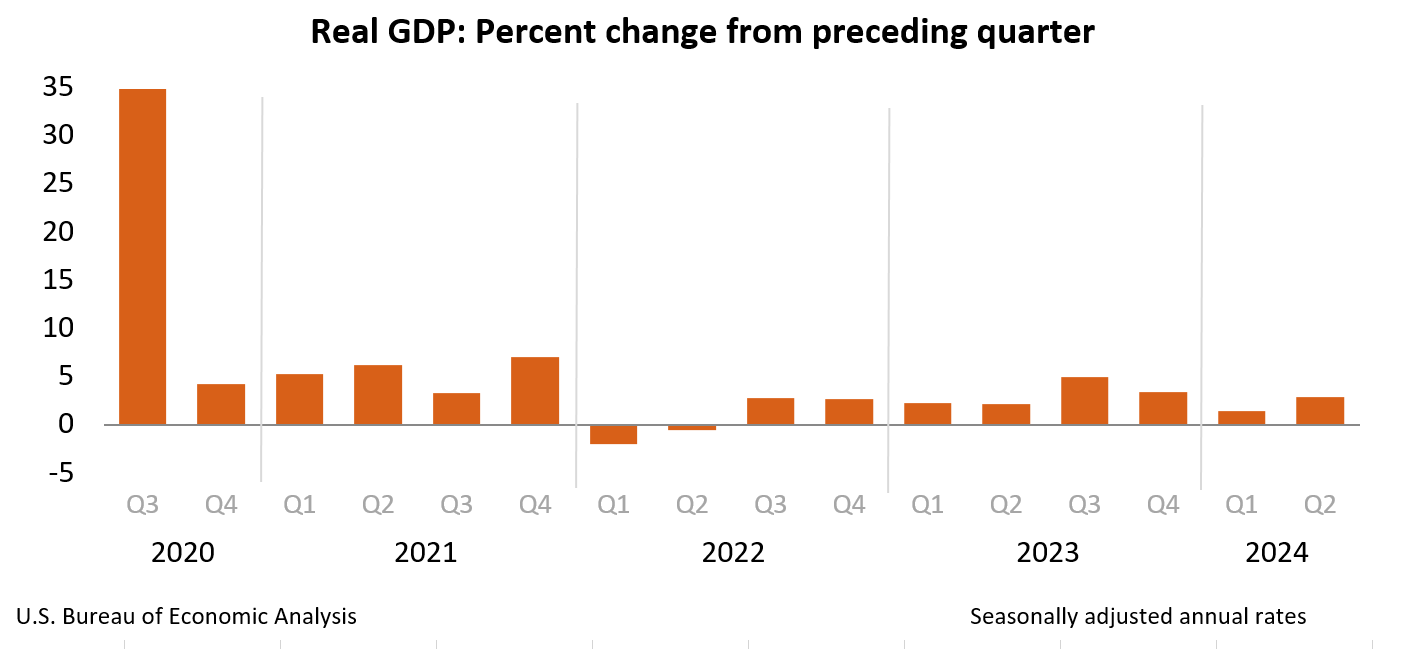

- According to the Bureau of Economic Analysis, the US economy expanded at an annualized rate of 2.8% in the second quarter, up from 1.4% in the first quarter and above the consensus forecasts of 2%.

- Consumer spending accelerated from the first quarter, climbing from a 1.5% annualized rate to 2.3%. Goods consumption spurred the rebound, which rose at a rate of 2.5% in Q2 after falling at an annualized rate of -2.3% in the first quarter. Motor vehicles, recreational goods and vehicles, and gasoline led growth in goods consumption while services slowed from a rate of 3.3% last quarter of 2.2%.

- Notably, private inventories contributed positively to consumption during the quarter after being a drag on it during the last two quarters.

- Residential investment contracted for the first time in a year while non-residential investment accelerated from a 4.4% rate to 5.2%, led by equipment, which grew at more than eight times the rate in the first quarter.

- Government spending accelerated in Q2, led by defense, while net trade continues to drag down growth as imports rose faster than exports.

2. BEIGE BOOK

- The Federal Reserve’s Beige Book summary of economic activity reported that in the six weeks ending on July 17th, the US economy grew at a slight to modest pace in most districts, but five of the twelve districts reported flat or declining activity.

- The data reflects activity that is also captured in this week’s second-quarter GDP estimate but offers an under-the-hood snapshot of the US economy’s regional differences, labor market activity, and economic sentiment.

- While the advanced estimate of second-quarter GDP released on Thursday reported an acceleration from the previous quarter, the five districts reporting flat or declining activity in the most recent Beige Book also accelerated— three more than the last report.

- Wages continue to grow at a modest to moderate pace in most districts, the Fed reports. Prices also rose modestly, while household spending was little changed. The interactions of these three metric trends over the next several weeks will play a critical role in determining whether policymakers move forward with a widely expected September interest rate cut.

- Many districts noted softer demand for consumer and business loans while reported activity on residential and commercial real estate markets varied. Travel and tourism were roughly on par with seasonal expectations, and a retail inventory buildup spurred notable growth in the transportation sector.

- Expectations for the six months ahead forecasted slower economic growth stemming from uncertainty around the US election, domestic policy, geopolitical conflict, and inflation.

3. INTEREST RATE FORECAST

- The stronger than expected second quarter GDP report shifted market expectations for number of rate cuts that will take place in 2024, though expectations for the timing of the first rate cut have largely held.

- According to the Chicago Mercantile Exchanges Fed Watch Tool, there is still an 88.2% chance of a September rate cut, down from 92.0% one week ago.

- On the day before the Q2 GDP report, futures markets projected a 52.7% change that there would by three quarter-percentage point rate cuts by the end of year. However, by the end of the trading day on Thursday, an overwhelming 87.7% forecast the policymakers will hold rates steady through the end of the year following an initial cut in September.

4. MID-YEAR COMMERCIAL PROPERTY OUTLOOK

- A recent mid-year report from Capital Economics forecasts that transaction activity is likely to bottom out over the summer months — but that valuations may have more declines to undergo before similarly inflecting.

- The report’s analyst suggests that valuations would need to fall an additional 12% from Q1 levels to properly reflect the impact of higher interest rates. This will show up through rising cap rates, which they expect to climb another 80 bps before reaching a cyclical peak at the start of next year.

- Treasury yields are forecasted to stay elevated this year despite the prospect of rate cuts, while the report projects NOI yields to climb further in 2025 as the market rebuilds yield gaps to adjust to the new rate path before stabilizing in 2026.

- Office yields are expected to see the largest rises to close 2024, while industrial and apartments are expected to lead the way after, though the latter two sectors are projected to be first and second in rent growth between 2024-2028, respectively.

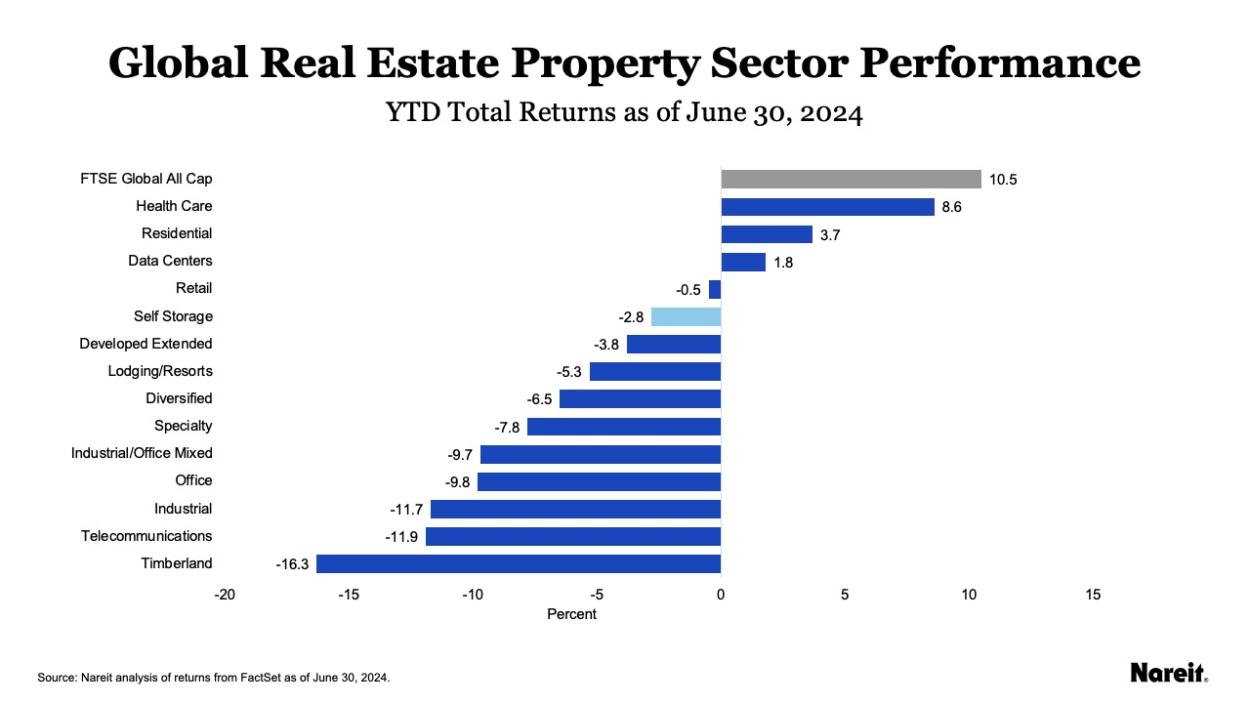

5. REIT MID-YEAR REPORT

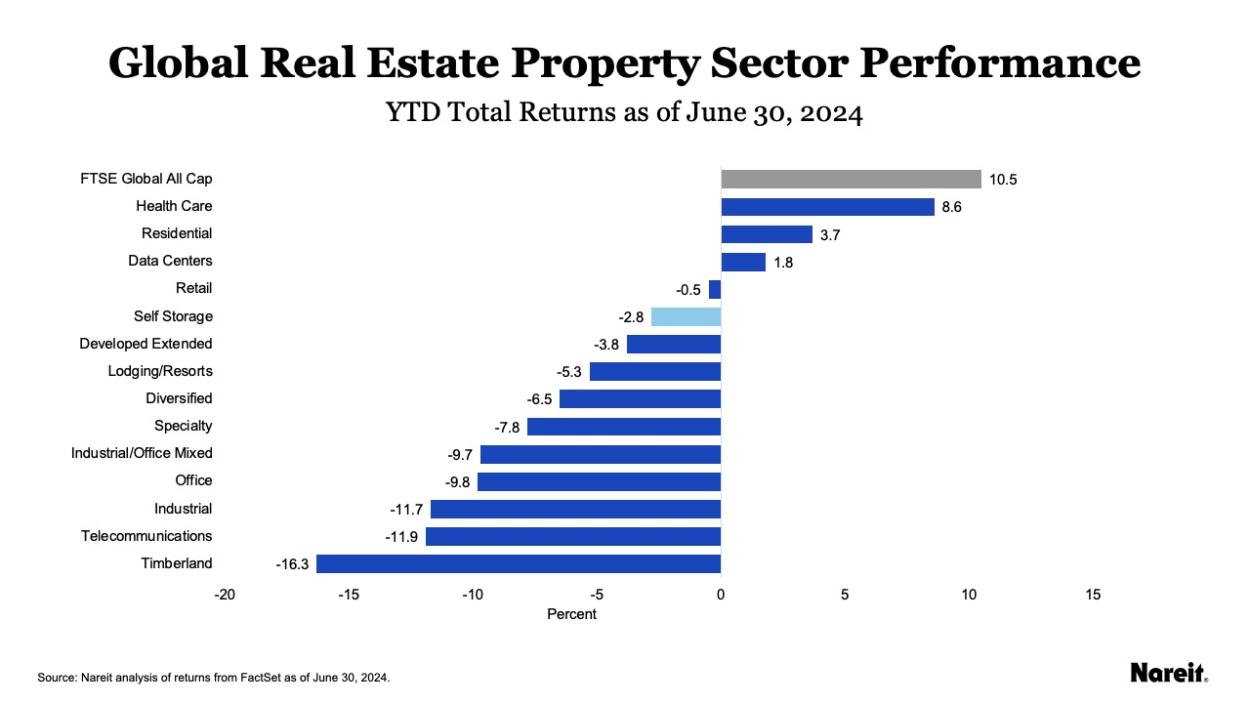

- Nareit reports that through June 30th, the FTS EPRA Nareit Developed Extended Index, an index series made up of REITs and global publicly listed real estate assets, was down 3.8% on a year-to-date basis.

- While in contraction, the latest data is an improvement from a 9.4% decline in mid-April that coincided with a spike in Treasury yields.

- Health care (+8.6% YTD), residential (+3.7% TYD), and data center (1.8% YTD) REITs have outperformed others in 2024. Timber (-16.3% YTD), telecommunications (-11.9% YTD), and industrial (-11.7% YTD) REITs, which represent close to a third of the index, have lead declines.

6. CONFERENCE BOARD US ECONOMIC FORECAST

- According to the Conference Board’s recent forecast for the US economy, released two weeks before the second-quarter GDP advanced estimate, GDP growth is expected to continue to slow in 2024 before picking up at year’s end and into 2025.

- The report forecasts a slowing economy in the short term as elevated prices and interest rates continue to sap demand. The forecast relied on first-quarter data that showed a dramatic deceleration in US GDP growth to just a 1.4% annual rate, down from 3.4% in the fourth quarter of 2023. Second-quarter 2024 GDP estimates were not yet available, but growth rates of 2% and 1% in the second and third quarters, respectively, were assumed in these projections.

- An acceleration of GDP growth at the turn of the year and into the next as inflation subsides and the Fed begins rate cuts. However, the trend of inflation in the next couple of months and the timing of the Fed’s first rate cut will dictate when this potential acceleration would begin.

7. CHIP AND SCIENCE ACTS SPUR CRE DEMAND

- A recent GlobeSt article investigates the impact of the CHIPS and Science Acts on commercial estate markets, as the 2022 laws introduced $52.7 in new spending, including both funding and incentives, for R&D and manufacturing in key science and tech sectors.

- The Texas market of Sherman-Denison was a key recipient of new federal funds with new semiconductor plants built by players like Texas Instruments and GlobiTech. The medium-term impact on the market includes the addition of up to 5,000 new jobs, bringing new residents and housing needs. The region is currently home to just 6,800 apartment units, reflecting the need for developers to fill the impending shortage.

- While the Real Page data underpinning the Sherman-Denison example focused on the multifamily impact, the article notes that retail demand has also likely increased, with school and healthcare needs likely to follow.

- Economists largely expect the laws to incentivize companies to increase manufacturing in the US and will benefit regions with strong labor force dynamics, available skills, and a diverse supplier base—thereby increasing demand in local real estate sectors. However, whether the economic stimulus of the medium-term investment in these sectors is sustained remains to be tested and will help determine the long-term viability of such CRE investments.

8. NAHB HOUSING MARKET INDEX

- According to the latest NAHB Housing Market Index (HMI), builder confidence in the market for single-family homes fell by one index point in July from the previous month.

- The downtick is a declaration from May and June, which saw the index decline three and two index points month-over-month, respectively.

- Present sales conditions fell during the month while expected sales conditions in the next six months rose, and traffic of prospective buyers declined.

- The July survey also showed that builders are increasingly cutting prices to bolster home sales, with 31% of all builders doing so in July compared to 29% in June and 25% in May.

- Despite the increased price cutting, the report notes that the average home price reduction held steady at 6% for the 13th straight month.

9. EXISTING HOME SALES

- According to the latest data from the National Association of Realtors, existing home sales declined by 5.4% between May and June to a seasonally adjusted annualized rate of 3.89 million units, the sharpest decline since 2022.

- June saw the fewest number of sales so far this year, and it was the fourth consecutive monthly decline in existing home sales, with median home sales prices climbing to a record high of $426,900.

- Unsold housing inventory rose by 3.1% from May to 1.32 million units, the equivalent of 4.1 months of supply at current housing prices.

10. RETAIL SALES

- US retail sales stalled in June, according to the latest data from the US Census Bureau.

- Following an upwardly revised 0.3% increase in May, retail sales were flat month-over-month. Sales at gas stations were down 3.0%, and sales for autos dropped 2.3%. Sales also fell at sporting goods, hobby, music, and bookstores.

- Meanwhile, sales at non-store retailers rose during the month, climbing 1.9% from May. Building materials and garden equipment sales were up 1.4%, while sales at health and personal stores rose 0.9%. Other items such as clothing, furniture, electronics and appliances, general merchandise, and food and drinking places also increased sales during the month.

- All in all, excluding gasoline, retail sales were up 0.2% in June, suggesting that consumer cutbacks in gas demand are not translating into a decline in broader consumption.

SUMMARY OF SOURCES

1. BANK STRESS TESTS

- According to the Federal Reserve, all 31 “systemically important financial institutions” (SIFIs) passed their annual stress tests. These tests evaluate the ability of large US banks to absorb hypothetical losses while maintaining more than their minimum required capital levels.

- The stress tests evaluated banks under a scenario where the unemployment rate surges to 10%, commercial real estate values fall by 40%, and housing prices fall by 36%. The results showed that large banks would take roughly $685 in aggregated hypothetical losses, but each would remain solvent.

- Following the recent failures of several mid-sized US banks, which, as a segment of the market, hold a disproportionate share of CRE on their balance sheets, the hypothetical resilience of banks shown during the stress tests is a welcomed sign. However, the stress tests evaluate only large and systemically important banks, leaving the conditions of regional banks in such potential scenarios relatively unknown.

2. COMMERCIAL PROPERTY PRICES

- According to the MSCI-RCA commercial property price index (CPPI), US commercial sector prices declined at an annual pace in May that was roughly similar to the rate seen in April.

- Prices fell 2.3% year-over-year through May and are down 0.2% from April.

- The industrial sector again arose as the only property type with an annual or monthly increase during the month, climbing 0.9% month-over-month from April and 8.7% over the past 12 months.

- Apartment sector prices fell by 0.1% month-over-month and by 8.9% year-over-year in May.The annual decline in retail prices eased for the 10th consecutive month but fell by 1.8% year-over-year through May. Retail prices are down 0.2% from April.

- Suburban Office properties reversed a monthly uptick in prices during April to post a 0.4% decline in May. Suburban office prices are down by 10.9% over the past twelve months. Meanwhile, CBD office prices continue to fall more steeply than their suburban counterparts, falling 1.4% from April and down by 30.8% year-over-year.

3. FLIGHT TO QUALITY IN OFFICE

- A recent Globe Street article points to a trend of flight to quality in the office sector, showing the nuances in office market activity despite recent struggles.

- Top their office marketbuildings maintain robust fundamentals. Rent premiums in prime office spaces sit at 84% while vacancy rates are down to 14.8%, 4.5% lower than the rest of the office market. Moreover, the sector’s performance gap has widened significantly from the 1.9% registered in 2018.

- Further, office market troubles have shrunk the sector’s construction pipeline, allowing more room for rent increases in prime space as they absorb remaining demand.

- The study notes that such prime spaces account for just 2% of US office buildings and that 60% of them were constructed in the past decade.

4. OFFICE MATURITIES TICK-UP

- According to recent data from Moody’s, a staggering $2.24 million across 23 CMBS office loans reached fully extended maturity in May.

- The 23 loans represent 54% of all maturities year-to-date. Moreover, loan size appears to play an essential role in determining payoff success. In both 2023 and 2024, smaller loans have paid off at a higher rate than larger ones.

- Year to date, Office loan maturities remain the lowest across all property types. 92.4% and 91.9% of Industrial and Multifamily loans have matured, respectively. When excluding malls, retail has seen a 78.0% payoff rate, but this falls to 53.9% when including mall loans. Meanwhile, 43.5% of Hotel loans are paid off through the end of May.

- Looking ahead, the balance of office loans maturing over the next 12 months totals $19.1 billion, 70% of which, according to Moody’s, have performance characteristics that indicate that they will face difficulties in refinancing.

5. BGO CRE OUTLOOK

- A recent Q2 2024 CRE outlook by BGO shows that market fundamentals remain firm, capital markets are stabilizing, and most emerging risks remain exogenous.

- As expected, Industrial maintains the strongest fundamentals across all of CRE, but some normalization and buildup of excess supply is expected in the coming months.

- On Retail, BGO maintains a positive outlook as low vacancies and healthy rent growth continues to keep the sector strong by historical standards.

- Multifamily has experienced a slowdown from its post-pandemic boom, with vacancies climbing in some of the markets that had the highest during the boom. BGO sees the vacancy rate stabilizing toward the end of the year before a potential down cycle in 2025, while rent growth is expected to gradually reaccelerate.

- Capital markets appear to be stabilizing, though transaction volume continues to be effectively flat. Delinquencies are increasing, and BGO sees this pattern continuing despite the likelihood of improved overall performance on the horizon.

- The report noted that monetary policy remains the primary risk to CRE and that, despite solid fundamentals, CRE markets will be beholden to the future path of interest rates.

6. ZOOMING IN ON HOUSING AFFORDABILITY

- Recent research from Zillow shows that a median-income household would need to put down 35.4% of their income to afford payments on a typical US home.

- The article highlights, for example, that a median-income household in Seattle making $116k would need to save 10% of their annual salary for 24 years to build up the savings that are typically expected for prospective homebuyers.

- Staggeringly, in 2023, 43% of home buyers used a gift from family or friends to help with their down payment.

- Affordability issues became increasingly salient as housing prices boomed during the pandemic years. Still, public policy responses have been slow to address them and are driven mainly by state and local initiatives. The US Department of Treasury recently outlined a new fund to provide an additional $100 million over the next three years to support the financing of affordable housing, while advocates are eyeing a White House budget proposal that would include mortgage relief credit for middle-class first-time homebuyers.

7. NAHB HOUSING MARKET INDEX

- According to the National Association of Home Builders’ Housing Market Index (HMI), each of the index’s components (current sales conditions, expected sales conditions, and traffic of potential homebuyers) fell in June from the previous month.

- The index, which evaluates homebuilder sentiment for the single-family home market, shows that builder confidence has stalled as interest rates have remained higher for longer than much of the market anticipated.

- Notably, this month’s survey shows that 29% of builders cut home prices in the past 30 days to boost sales, the highest share since January.

- May was the first month since December where each component of the HMI was in contraction.

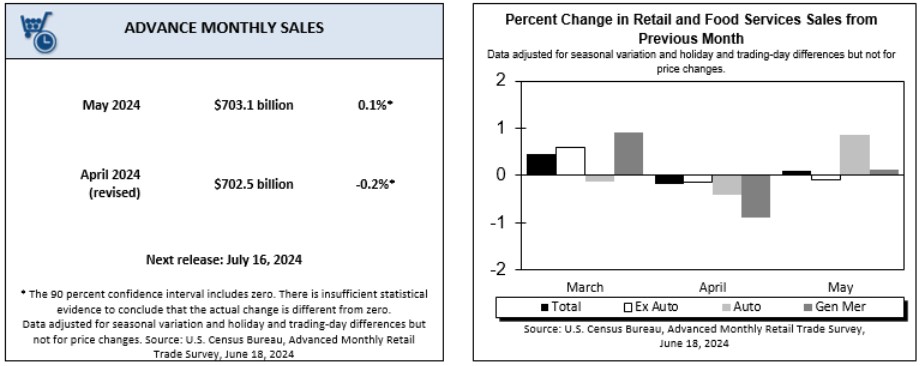

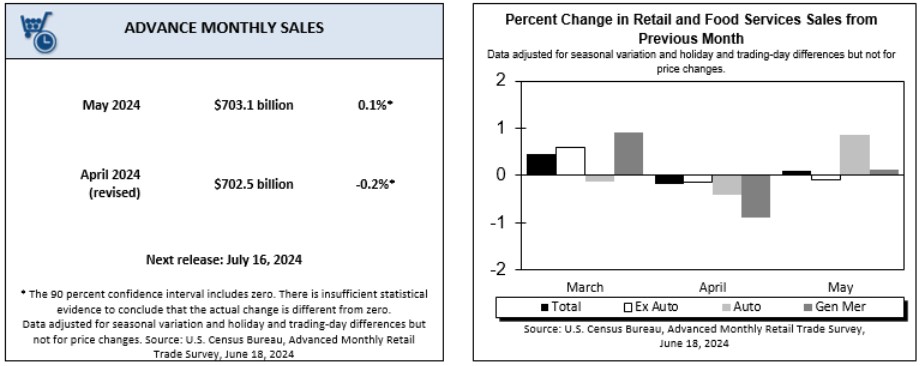

8. RETAIL SALES

- According to the latest data from the Census Bureau, US Retail and food services sales (seasonally adjusted) rose by 0.1% in May from the previous month and 2.3% from one year ago.

- Overall, while positive, these data came in weaker than expected, with the Dow Jones consensus estimate forecasting a 0.2% increase during the month.

- Zeroing in on retail trade, sales were up 0.2% from April and 2.0% from May 2023. Over the past year, non-store retailers have seen an increase in sales of 6.8%, while food services and drinking places have increased by 3.8% over the same period.

- Following the report’s release, the likelihood of a Fed rate cut in 2024 climbed higher as measured by Fed funds futures markets.

9. CONSUMER CONFIDENCE

- Consumer confidence, as measured by The Conference Board, fell slightly in June but remained within its relative range over the past two years.

- Notably, the two subcomponents of the index, one measuring the present situation and one measuring future expectations, diverged in the latest reading. The Present Situation index rose during the month while short-term expectations fell. However, the expectations index metric has sat within the recession threshold for the last five months, which has failed to align with reality.

- Peeling one layer deeper, consumers expressed an overall increase in confidence in labor market conditions within both the present situation and expectations index. In contrast, their views on income and business conditions fell in both components.

- The report also noted that the decline in confidence was primarily driven by consumers aged 35-54, while the cohorts above and below this age group saw a boost in confidence.

10. RISING COSTS IN THE MULTIFAMILY SECTOR

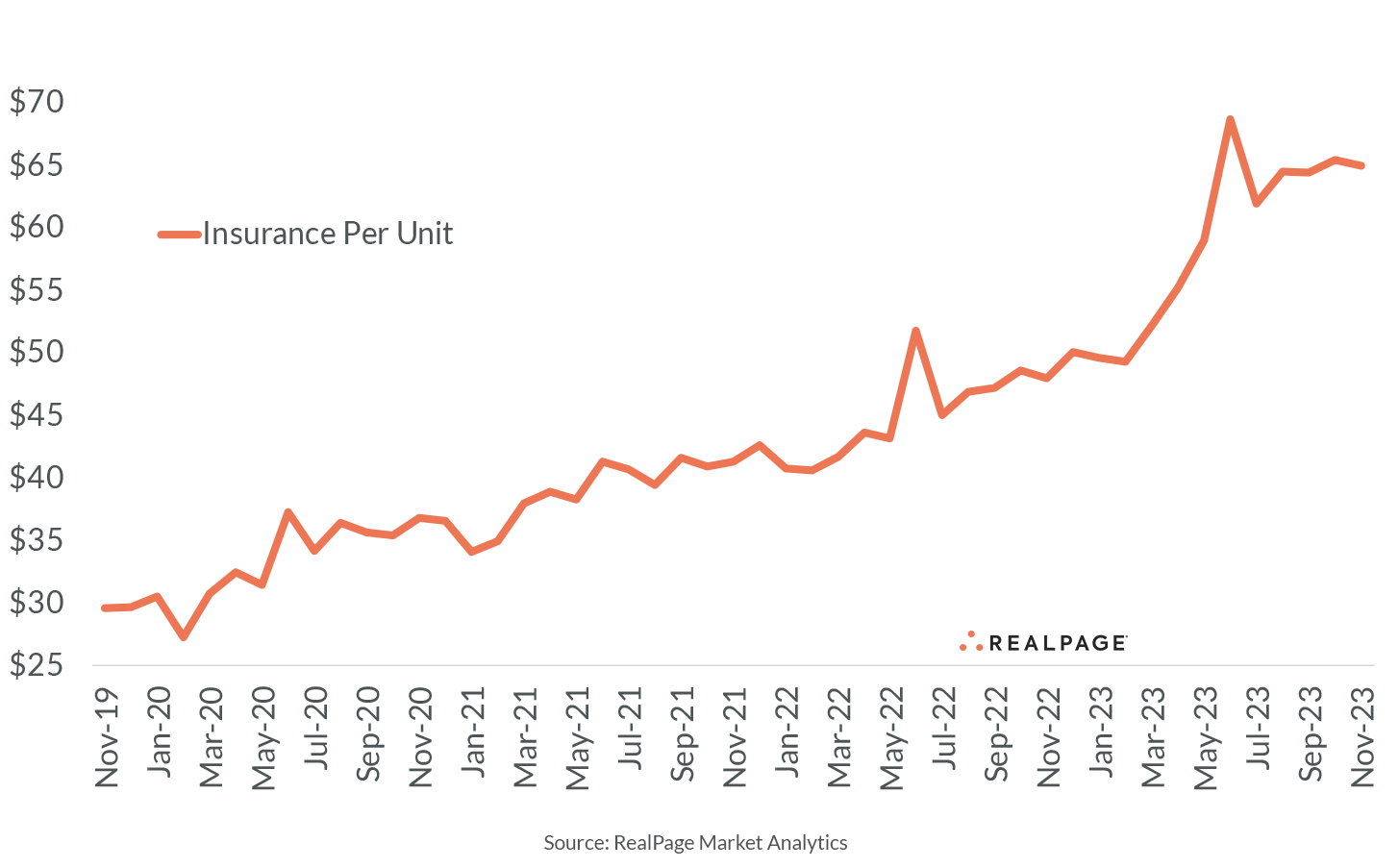

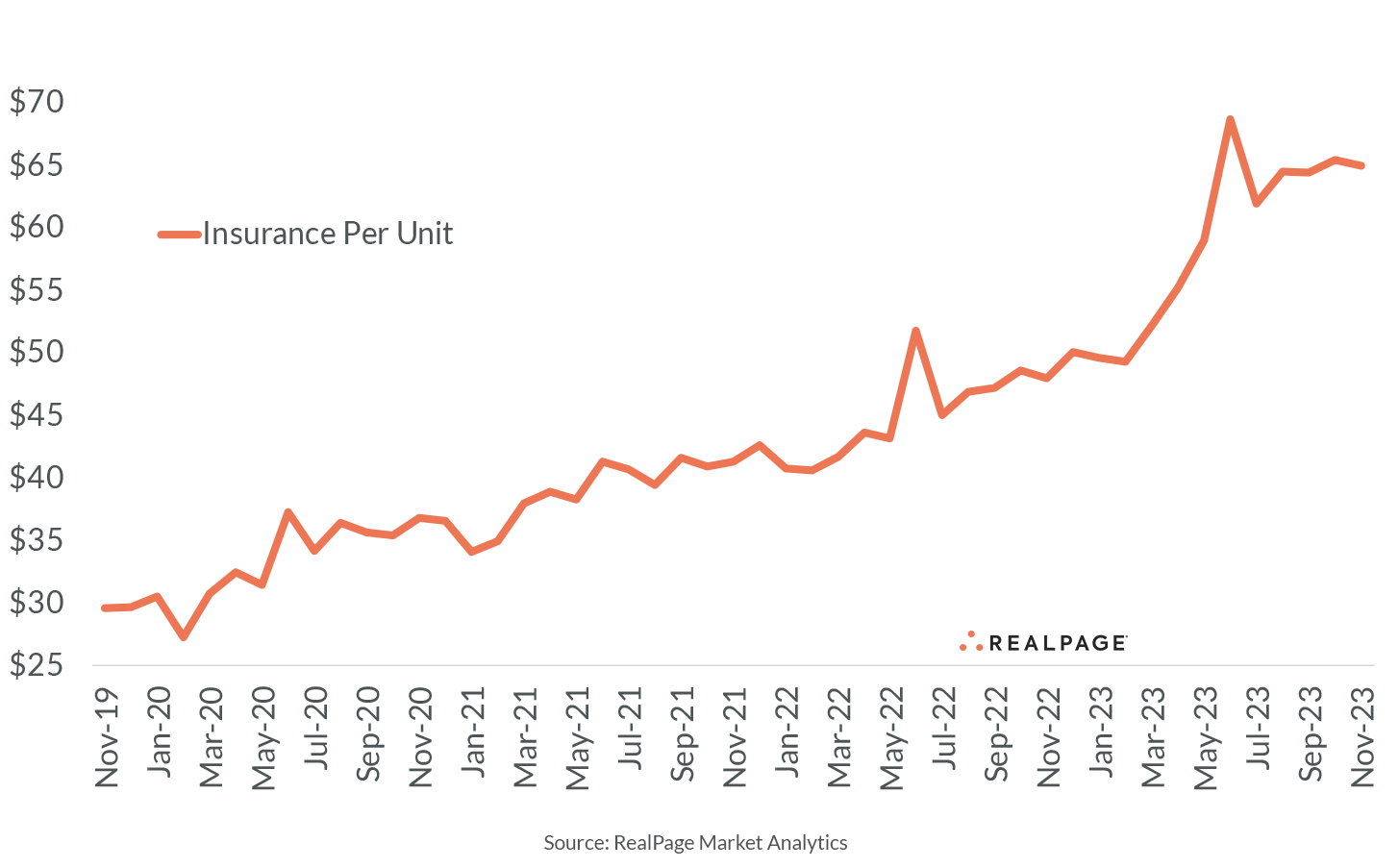

- A recent study by the Joint Center for Housing Studies at Harvard University shows that rising insurance premiums were the main cause of higher operating costs in the Multifamily sector heading into this year.

- Citing data from RealPage, the report detailed that through January 2024, insurance premiums in the sector rose 27.7% year over year and were a significant contributor to the 7.1% increase in total operating expenses over the same period.

- Within the nation’s top 50 metros, per-unit insurance costs have more than doubled since the start of the pandemic. Further, NOI growth slowed to just 2.8% in Q1 2024 compared to 24.8% at the end of 2021.

- The rising costs can increase the risk of multifamily loan delinquencies. However, the report notes that delinquencies in the CMBS market remain well below their GFC comparisons and just slightly above their pre-pandemic average.

SUMMARY OF SOURCES

1. CRE LOAN MODIFICATIONS RISE AMID HIGH-RATE ENVIRONMENT

- According to a new report by Trepp, CMBS loan modifications rose dramatically in 2023 as a significant swell of loans are set to mature in the coming quarters.

- Modification volumes peaked mid-year 2023, climbing to $3.9 billion during the third quarter, almost nine times higher than levels one year before.

- Perhaps unsurprisingly, Office loans have received the largest volume of new modifications recently, making up roughly 42% ($4.2 billion) of all modifications made during 2023. Retail was the second largest, with $2.6 billion in loans modified.

- The jump in loan modifications within the CMBS universe signals how the broader Commercial Real Estate financing system is beginning to tackle the looming challenge of new financing needs amid lower property values and higher interest rates.

- Instead of refinancing old loans, borrowers are increasingly seeking extensions or amendments to current loan terms. These can sometimes involve the borrower committing new capital in the form of paying down debt, investing in renovations, or making other tenant improvements.

2. AI FUELS DATA CENTER BOOM

- A recent report by Baystreet estimates that Data Center investments have surged by more than 200% since 2016. The traditionally more niche asset class is expected to expand by another 89% between now and the end of 2028 as AI propels the property type to new heights.

- Several tech companies and firms that have been early to invest in generative AI have sat at the forefront of the recent trend. Big names such as Amazon, Applied Digital Corporation, and Avant Technologies, among others, signal that they expect to expand their AI infrastructure further as demand continues to boom.

- The intersection of AI and Commercial Real estate reveals recent activity by industry lenders and could signal broader trends in real estate finance. For example, Equinix, Inc., another large player in the digital infrastructure space, has recently launched a $600 million joint venture with PGIM Real Estate to help develop and operate a new Data Center in Silicon Valley.

- As more traditional CRE lenders, such as mid-sized regional banks, pull back from real estate investments due to the interest rate climate, alternative lenders like PGIM are stepping into the vacuum. As an emerging and less matured asset class, data center investment activity by traditional alternative lenders will be an interesting indicator to watch.

3. HOME PRICES IN TOP METROS HIT RECORD

- According to the latest data from S&P/CoreLogic, home prices in the top 20 major US metros climbed to their highest level on record in March.

- The S&P CoreLogic Case-Shiller 20-city house price index rose 0.3% monthly and 7.4% year-over-year in March, the latest month of available data.

- After eight consecutive months of price deceleration that partly overlayed three months of price declines, national home prices tracked by the Case-Shiller Index reaccelerated in the three months ending in March.

- Housing prices in major markets continue to face upward pressure from falling inventories, which is further exacerbated by the start of the Spring homebuying season.

- In recent weeks, pressure on inventories has eased slightly. According to the National Association of Realtors, housing inventory totaled 1.21 million units at the end of April, 9% above March’s level and up 16.3% from the same time last year. Still, as pricing trends show, this pace has not kept up with demand.

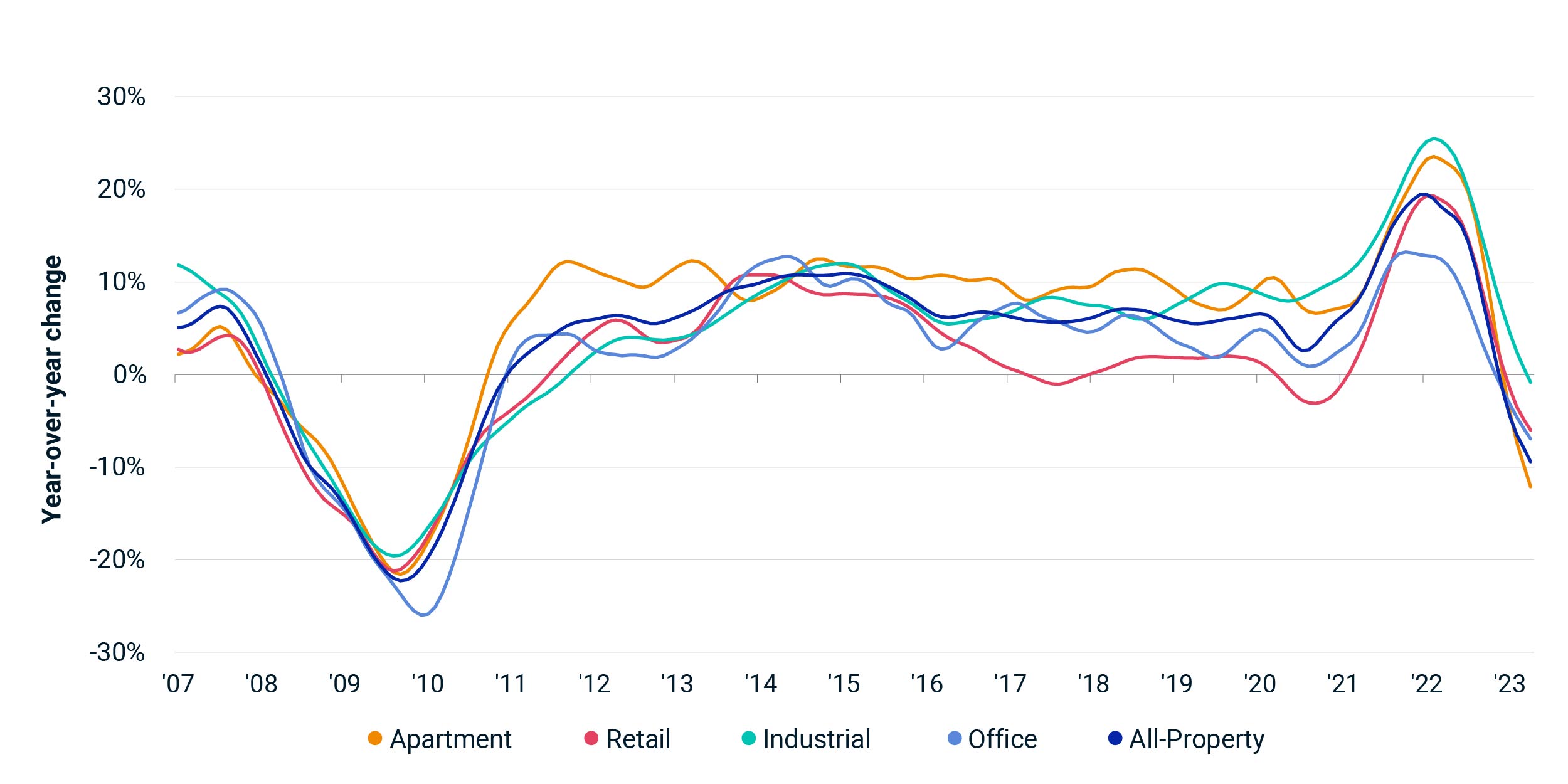

4. COMMERCIAL REAL ESTATE PRICES

- According to the MSCI-RCA commercial property price index (CPPI), the pace of decline in US commercial sector prices slowed for the ninth straight month in April.

- Prices fell 2.2% year-over-year through April and just 0.1% from March.

- The industrial sector again arose as the only property type with an annual increase during the month, climbing 0.6% month-over-month from March, its 12th consecutive monthly increase. Industrial prices are up 6.0% over the past 12 months.

- The annual pace of decline for Apartment sector prices has slowed in each of the last eight months, with prices charting a 6.9% year-over-year decrease in April. Monthly, Apartment sector prices are down 0.3%,

- Retail sector prices also improved. The sector’s annual price decline eased for the ninth consecutive month to 2.6% year-over-year in April. However, relative to March, sector prices are down.

- Suburban Office properties experienced a slight monthly uptick, rising 0.5% month over month. Annually, CBD office prices continue to fall more steeply than their suburban counterparts, falling 33.9% year over year compared to just 7.8%.

5. LUXURY RETAIL EXPANDS

- According to new reporting by Globe St that analyzes trends in New York and major European markets, leading luxury retailers are snapping up store space.

- High-end retailers are increasingly opting to purchase prime units in major cities across the globe instead of leasing as they take advantage of discounted property prices.

- According to Bernstein Research, European luxury brands have paid upwards of $9 billion since the beginning of 2023 to buy prime space in the world’s top shopping locations, such as New York and Paris.

- Some brands have indicated that they continue to bet on consumers’ spending resilience, which is expected to experience its fourth consecutive annual increase in 2024.

6. OFFICE EXPOSURE RISK

- Commercial Edge’s May 2024 national office report details the risk several markets could be exposed to concerning Office sector distress.

- Analyzing debt service coverage ratios (DSCRs), which measure net operating income against current debt obligations, the report notes that only five of the 91 markets in focus had DSCRs below 1.0, a level that the researchers associate with high risk.

- Lenders often require a DSCR of 1.25 to consider a business to have sufficient net operating income to repay a loan. The report found that only a handful of markets are presently exposed to widespread risks.

7. CONSUMER CONFIDENCE REBOUNDS

- According to the latest release, the Conference Board’s Consumer Confidence Index rose in May following three consecutive monthly decreases.

- US consumers showed an unexpected surge in optimism over the past month as the labor market outlook improved. Still, inflation concerns persist, and as a result, households continue, on average, to expect higher interest rates over the next year.

- The survey’s underlying data suggested a more mixed outlook. The share of consumers who expect a recession over the next 12 months increased on a month-over-month basis. Conversely, consumers remain relatively upbeat about the stock market.

- In a potential foreshadowing of how May’s mixed report could translate into consumer spending trends, the share of respondents indicating that they plan to buy a major household appliance also ticked up from April.

8. FEDERAL DEBT WORRIES

- As the US national debt approaches $35 trillion, there are increasing concerns about the nation’s fiscal health.

- Since the onset of the COVID-19 pandemic in March 2020, the federal government has added about $11 trillion in debt. While US economic growth and the dollar’s position as a global reserve currency have often placed deficit reduction on the back burner of fiscal priorities for both political parties, recent debt growth is again raising some alarms.

- The four-year uptick is largely due to a massive expansion of government spending, namely the pandemic-era stimulus packages in 2020 and 2021, followed by the 2022 Bipartisan Infrastructure and Inflation Reduction Acts.

- Increasing deficits have also been exacerbated by previous reductions in tax revenues, including the 2017 Tax Cuts and Jobs Act, and the increasing strain from rising interest rates, which increase the government’s debt liability.

- The Congressional Budget Office (CBO) estimates that the public’s debt-to-GDP ratio, which currently stands at 99%, will rise to 116% over the next decade, which would become its largest proportion in history.

- The CBO projects a $1.6 trillion deficit for 2024 that will increase to $2.6 trillion by 2034 if current fiscal revenues and spending levels continue on trend. Many economists note that the US has historically only experienced such deficit-to-GDP levels during wartime or severe downturns. Such levels could place the US government in a position of fiscal vulnerability during a downturn.

9. FOMC MEETING MINUTES

- According to the meeting minutes from the FOMC’s April 30th- May 1st policy meeting, while policymakers continue to expect inflation to remain on its trend towards 2% over the medium term, most believe that recent data has necessitated a more cautious approach.

- The minutes point to an increasing sentiment among officials that the disinflation processes will likely take longer than previously thought. Some members also indicated a willingness to raise rates further if inflation pressures mount.

- As inflation data trended in an unfavorable direction over the first quarter of 2024, officials have grown notably more cautious in their statements on the future path of rate policy but have mostly refrained from overly hawkish sentiments that would indicate a return to rate hikes.

- So far, FOMC officials have responded to this year’s inflation risks by leaving their benchmark Federal Funds Rate unchanged at recent meetings. However, they have left the door open to rate cuts later in the year if underlying economic data improves.

10. INTEREST RATE OUTLOOK

- According to the Chicago Mercantile Exchange’s Fed Watch Tool, the average futures market forecasts for the Federal Funds Rate at the end of 2024 have recently shifted to reflect only one quarter-percentage point cut.

- Futures markets place a 42.1% chance that the Fed funds rate will finish the year 25 bps down from its current level. The shift is a significant recalibration from earlier this year when futures markets projected at least three quarter-point cuts in 2024.

- Higher than expected inflation pressures to start 2024 have resurfaced futures markets’ hawkish sentiments, aided by recent Fed commentary suggesting a longer path ahead toward a pivot.

SUMMARY OF SOURCES